Colorado has been a 4/20 destination for more than a decade, and the allure of tax dollars helped spur a legalization movement that now brings tens of millions of consumer dollars into the state every April.

Data from the Colorado Department of Revenue shows that Colorado made $2.49 million from the state's 2.9 percent marijuana sales tax in March 2016. (That includes medical and recreational dispensaries and doesn't count the 10 percent retail marijuana tax and other local taxes specific to cities and counties.) In May 2016, Colorado made $2.76 million from the same tax. But in April 2016, that tax total was significantly higher than in the preceding and following months: $3.29 million. Dispensary sales aren't just rising in April; they're rising annually, at an extremely fast rate.

Commercial marijuana data and analytics firm BDS Analytics has been tracking dispensary sales since 2014 and says Colorado nearly doubled its 4/20 spending in 2016 compared to 2015 – and more than tripled 4/20 spending compared to 2014, the first year of recreational cannabis sales.

Colorado dispensaries saw $2.44 million in sales on April 20, 2014, with people buying over 266,000 grams of marijuana flower that day, according to BDS. That was dwarfed by 4/20 in 2015, which saw $4.75 million in flower sales and more than 672,000 grams sold. Still, the first two years combined were overshadowed by 2016, with consumers spending $7.47 million on over 880,000 grams on 4/20 last year.

Dispensary sales spiking in April compared to other months probably won't surprise many of you – but exactly what are we spending all this money on?

Concentrates are coming

Overall recreational sales ballooned to $4.9 million on 4/20 last year, increasing more than 96 percent year over year. Medical sales saw a much smaller rise, at 13.9 percent over 2015, but still accounted for close to $2.6 million.

Coloradans moved toward stronger, more expensive options in 2016, according to BDS. Here's a breakdown of sales of the four most popular dispensary products in 2014 through 2016:

2014

Flower: 65 percent

Edibles: 16 percent

Concentrates: 13 percent

Pre-rolls: 3 percent

2015

Flower: 62 percent

Concentrates: 16 percent

Edibles: 13 percent

Pre-rolls: 4 percent

2016

Flower: 53 percent

Concentrates: 24 percent

Edibles: 14 percent

Pre-rolls: 6 percent

Hash, hash, hash

According to BDS, concentrates accounted for $1.8 million in medical and recreational sales on April 20, 2016, good for more than 65,000 grams of wax, shatter and other potent varieties – a 132.4 percent rise in sales volume and 189.4 percent rise in grams sold compared to 2015. Shatter was the most popular, at 28 percent of sales, but expect pre-filled vaporizer cartridges and live resin to see significant growth this year.

We still love edibles, too:

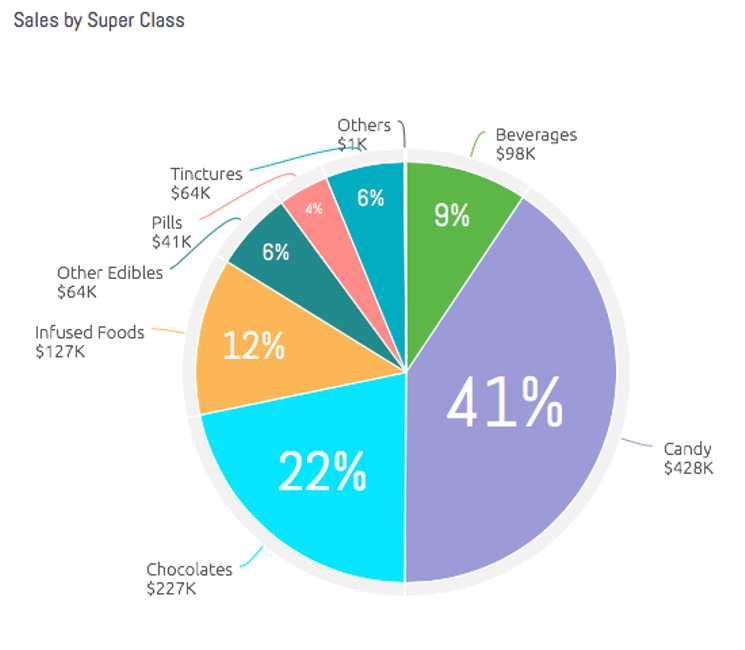

Edibles also show sharply rising growth on 4/20 since legalization, according to the data, albeit not quite as strong as that of concentrates. Edibles accounted for $1.05 million in overall sales on April 20, 2016, with over 73,000 units. That's a 65.6 percent increase in sales volume over 2015 and a 52.3 percent rise in units sold.

Recreational consumers were the driving force for edibles growth, buying nearly 30,000 more units and spending over $500,000 more on infused goodies than medical patients in 2016.

Candy bars and chocolates reigned supreme in 2016, and the rise of infused-gummy sales last fall will likely ensure that the trend continues.

This year, 4/20 falls on a Thursday – closer to the weekend than it was in 2016 (that was a Wednesday), and a much friendlier day to play hooky than the Monday of 2015. There will be holiday sales and weed-friendly events going on all over town, setting up this year's celebration to potentially become the most profitable 4/20 Colorado has ever seen.

Audio By Carbonatix

[

{

"name": "Air - MediumRectangle - Inline Content - Mobile Display Size",

"component": "12017618",

"insertPoint": "2",

"requiredCountToDisplay": "2",

"watchElement": ".fdn-content-body",

"astAdList": [

{

"adType": "rectangle",

"displayTargets": "mobile"

}

]

},{

"name": "Editor Picks",

"component": "17242653",

"insertPoint": "4",

"requiredCountToDisplay": "1",

"watchElement": ".fdn-content-body",

"astAdList": [

{

"adType": "rectangle",

"displayTargets": "desktop|tablet"

},{

"adType": "rectangle",

"displayTargets": "desktop|tablet|mobile"

}

]

},{

"name": "Inline Links",

"component": "18838239",

"insertPoint": "8th",

"startingPoint": 8,

"requiredCountToDisplay": "7",

"maxInsertions": 25

},{

"name": "Air - MediumRectangle - Combo - Inline Content",

"component": "17261320",

"insertPoint": "8th",

"startingPoint": 8,

"requiredCountToDisplay": "7",

"maxInsertions": 25,

"watchElement": ".fdn-content-body",

"astAdList": [

{

"adType": "rectangle",

"displayTargets": "desktop|tablet"

},{

"adType": "rectangle",

"displayTargets": "desktop|tablet|mobile"

}

]

},{

"name": "Inline Links",

"component": "18838239",

"insertPoint": "8th",

"startingPoint": 12,

"requiredCountToDisplay": "11",

"maxInsertions": 25

},{

"name": "Air - Leaderboard Tower - Combo - Inline Content",

"component": "17261321",

"insertPoint": "8th",

"startingPoint": 12,

"requiredCountToDisplay": "11",

"maxInsertions": 25,

"watchElement": ".fdn-content-body",

"astAdList": [

{

"adType": "leaderboardInlineContent",

"displayTargets": "desktop|tablet"

},{

"adType": "tower",

"displayTargets": "mobile"

}

]

}

]