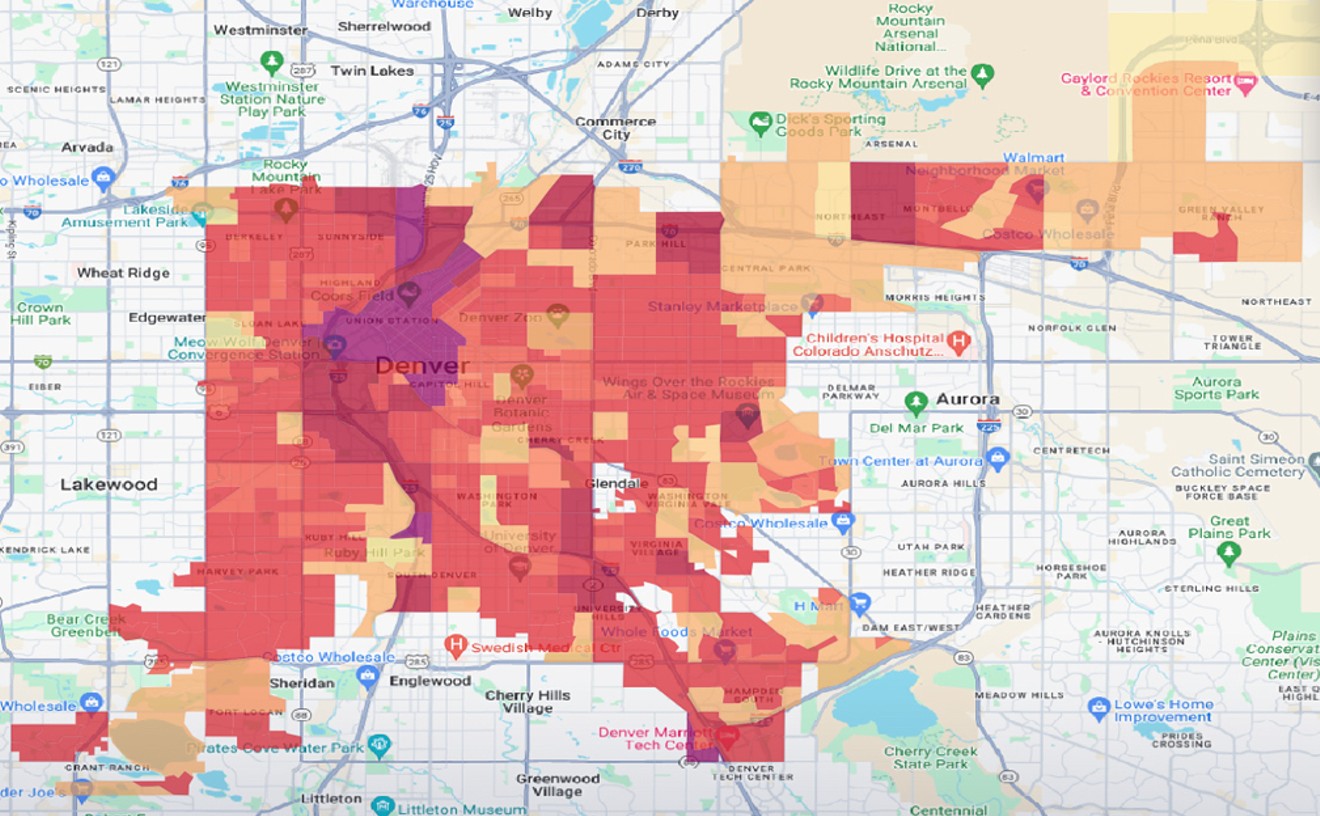

A just-issued study reports that home price growth nationwide reached a fifteen-year peak in February; of twenty major cities surveyed, Denver has seen costs rise the most over that span. But while metro area prices are predicted to keep going up over the course of 2021, the rate of increase is expected to slow down considerably from the record-setting pace currently scorching the housing market in the Mile High City.

Note that in the April market trends report from the Denver Metro Association of Realtors, released this week, the average price of a detached home in the Denver area sits at $674,990, an increase of more than $40,000 over last month and in excess of $100,000 above the same period a year ago.

The new analysis comes from CoreLogic, which shows that Denver's home price index, or HPI, in February 2021 was up 10 percent from the same period a year earlier. But the site also considers home prices in what is technically known as the Denver-Aurora-Lakewood Metropolitan Statistical Area to be overvalued. That's one of several reasons why CoreLogic deputy chief economist Selma Hepp forecasts that home price growth here will slow by more than four-fifths, to 1.9 percent, through February 2022.

Here's a CoreLogic graphic highlighting the combined HPI percent change for the Denver and eight other major metropolitan areas. Denver's year-over-year percent change is the third-fastest among those listed, behind Phoenix-Mesa-Scottsdale and San Diego-Carlsbad.

If CoreLogic's prognostications about home price growth in Denver finally ratcheting down sound familiar, they should: In July 2020, when the COVID-19 pandemic was just a few months old, Hepp estimated that home prices would dip in the 10 percent range by this spring — and they've done the opposite. In the following email Q&A with Westword, she details the unforeseen twists that altered the outcome and acknowledges that more twists could be coming. But she still believes price moderation is in Denver's future. Here's why.

Westword: According to the new figures, the Denver metro area has seen a year-over-year increase of 10 percent. What are the reasons for that large increase?

Selma Hepp: Home price acceleration to 10 percent year-over-year increase is in large part driven by imbalance between demand and supply for homes. While pandemic and low mortgage interest rates have provided significant incentive for potential home buyers to jump into the market, supply of homes for sale has been continually declining and reaching historical lows. In February, number of active listings was 58 percent below last February. Also, inventory in Denver had been fairly steady over the last six or seven years, but declined sharply in 2020. As a result, home price appreciation picked up pace in second half of 2020.

Despite the 10 percent increase, the new figures show a prediction of a 1.9 percent rise through February 2021 — lower than a lot of other major metros. Why does CoreLogic predict just a 1.9 percent year-over-year percentage change for the market?

Slowing of home price appreciation is expected as the recent rapid increase in home prices amid low inventories has led to affordability challenges for many potential home buyers. In addition, increase in mortgage rates will further limit budgets for many young families, who are comprising a large share of the home-buying population, thus reducing buyer competition. At the same time, as more people are vaccinated and baby boomers (who are the majority of home sellers) feel more comfortable putting their home on the market, there will be more homes for sale, which will also help reduce the pressure on home prices.

Are there signs that the Denver market is about to peak, and if so, what are they — and when might that peak be expected to arrive?

While home price growth may be reaching its peak, home prices are likely to continue rising, forecasted at 1.9 percent year-over-year in February 2022.

How does the increase in Denver home prices compare to those in other major metro areas?

Home prices in Denver are about 84 percent above their previous peak in 2006. Adjusting for inflation, Denver’s prices are 49 percent above the previous peak. According to Case Shiller HPI, Denver’s ranks with the highest increase since the previous peak out of the twenty cities measured.

Back in July 2020, you told us that signs pointed to the possibility that Denver's home-price growth would decline by this spring. Instead, prices rose by a great deal. I'm curious what things took place to cause that to happen and if more unexpected events could be in the offing.

At the onset of the pandemic, there was a lot of uncertainty around how it would affect our economy and the housing market. Expectations at the beginning were very grim. But as mortgage rates declined, stimulus package(s) were passed, and consumers realized that the pandemic may have longer term repercussions on their WFH [work-from-home] options, they came out in search for alternative housing options, whether that be larger primary residences or second homes. Sellers, on the other hand, hunkered down and postponed putting their homes on the market, bringing the available inventory of homes for sale to a historical low. At the same time, forbearance options allowed those in distress to postpone their mortgage payments and stay in their homes. All of these outcomes were not immediately obvious when the pandemic started.

Looking forward, there may be new twists, but the likelihood is low. Also, faster than expected increase in mortgage rates could put a damper on housing demand, which could slow home price growth faster than anticipated.

[

{

"name": "Air - MediumRectangle - Inline Content - Mobile Display Size",

"component": "12017618",

"insertPoint": "2",

"requiredCountToDisplay": "2",

"watchElement": ".fdn-content-body",

"astAdList": [

{

"adType": "rectangle",

"displayTargets": "mobile"

}

]

},{

"name": "Editor Picks",

"component": "17242653",

"insertPoint": "4",

"requiredCountToDisplay": "1",

"watchElement": ".fdn-content-body",

"astAdList": [

{

"adType": "rectangle",

"displayTargets": "desktop|tablet"

},{

"adType": "rectangle",

"displayTargets": "desktop|tablet|mobile"

}

]

},{

"name": "Inline Links",

"component": "18838239",

"insertPoint": "8th",

"startingPoint": 8,

"requiredCountToDisplay": "7",

"maxInsertions": 25

},{

"name": "Air - MediumRectangle - Combo - Inline Content",

"component": "17261320",

"insertPoint": "8th",

"startingPoint": 8,

"requiredCountToDisplay": "7",

"maxInsertions": 25,

"watchElement": ".fdn-content-body",

"astAdList": [

{

"adType": "rectangle",

"displayTargets": "desktop|tablet"

},{

"adType": "rectangle",

"displayTargets": "desktop|tablet|mobile"

}

]

},{

"name": "Inline Links",

"component": "18838239",

"insertPoint": "8th",

"startingPoint": 12,

"requiredCountToDisplay": "11",

"maxInsertions": 25

},{

"name": "Air - Leaderboard Tower - Combo - Inline Content",

"component": "17261321",

"insertPoint": "8th",

"startingPoint": 12,

"requiredCountToDisplay": "11",

"maxInsertions": 25,

"watchElement": ".fdn-content-body",

"astAdList": [

{

"adType": "leaderboardInlineContent",

"displayTargets": "desktop|tablet"

},{

"adType": "tower",

"displayTargets": "mobile"

}

]

}

]