For years, the Denver area housing market was so scorching that it seemed nothing could dial down the heat — and prices haven't dropped thus far, despite the local impact of the global pandemic. But a new report contends that metro home prices are seriously overvalued and predicts that they'll decline nearly 10 percent by the spring of 2021.

That's among the takeaways in the latest analysis from California-based CoreLogic.

The site calculates the Home Price Index, or HPI, for markets across the country, including the metropolitan sector that encompasses Denver, Aurora and Lakewood. While the study's authors acknowledge that Denver home prices are still on the rise overall, they expect that to reverse in a big way over the coming months.

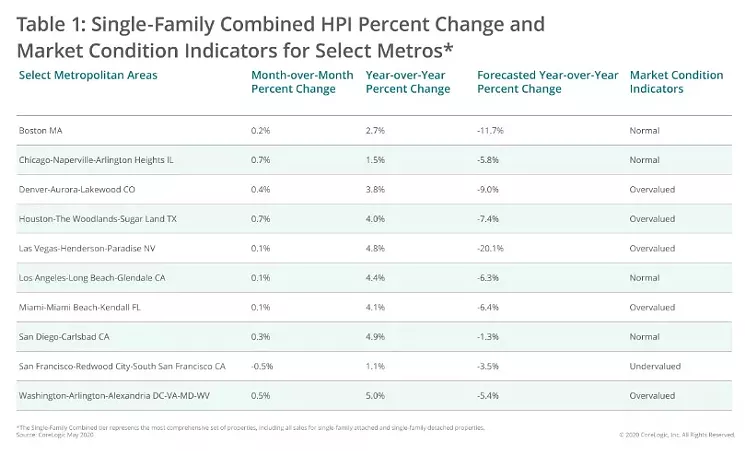

Here's the CoreLogic graphic that compares the HPI percentage change forecast for ten major metropolitan areas across the country, including Denver, through May 2021:

According to these stats, prices in the Denver market are up 3.8 percent over those in May 2019 — but by May 2021, they're expected to dip by 9.0 percent. That's the third-highest decline among the selected metro areas, behind only Las Vegas and Boston.

The predicted Denver dip also outpaces the one the report anticipates for the country at large. The CoreLogic study predicts that 125 metro areas in the U.S. have at least a 75 percent probability of a price decline by 2021, and the nationwide falloff is expected to be 6.6 percent, on average.

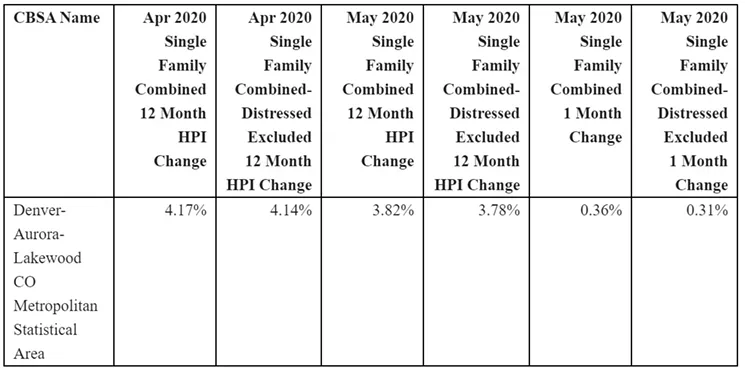

The early signs of this cool-down can be seen in the following graphic depicting the HPI in Denver for April and May, created by CoreLogic at Westword's request.

We asked CoreLogic deputy chief economist Selma Hepp to explain why the firm sees a price slide coming for Denver.

"Declines in HPI forecast are in large part driven by the expected unemployment rate over the next year," Hepp explains. "A large share of Denver jobs are in industries that have suffered as a result of COVID-19, such as mining, logging and construction and trade, transportation and utilities — but also fallen oil prices. Jobs in these industries are not expected to return as fast as leisure and hospitality or other services may."

Hepp adds that "the market conditions indicators that suggest the Denver market is overvalued are tied to growth in real disposable income per capita, which has grown at a slower pace than home prices."

Click to read the CoreLogic report.

Audio By Carbonatix

[

{

"name": "GPT - Billboard - Slot Inline - Content - Labeled - No Desktop",

"component": "23668565",

"insertPoint": "2",

"requiredCountToDisplay": "2"

},{

"name": "STN Player - Float - Mobile Only ",

"component": "23853568",

"insertPoint": "2",

"requiredCountToDisplay": "2"

},{

"name": "Editor Picks",

"component": "17242653",

"insertPoint": "4",

"requiredCountToDisplay": "1"

},{

"name": "Inline Links",

"component": "18838239",

"insertPoint": "8th",

"startingPoint": 8,

"requiredCountToDisplay": "7",

"maxInsertions": 25

},{

"name": "GPT - 2x Rectangles Desktop, Tower on Mobile - Labeled",

"component": "24956856",

"insertPoint": "8th",

"startingPoint": 8,

"requiredCountToDisplay": "7",

"maxInsertions": 25

},{

"name": "Inline Links",

"component": "18838239",

"insertPoint": "8th",

"startingPoint": 12,

"requiredCountToDisplay": "11",

"maxInsertions": 25

},{

"name": "GPT - Leaderboard to Tower - Slot Auto-select - Labeled",

"component": "17676724",

"insertPoint": "8th",

"startingPoint": 12,

"requiredCountToDisplay": "11",

"maxInsertions": 25

}

]